Key Takeaways:

- Trump hails Bitcoin as a “$10 trillion asset class” during Air Force One gaggle.

- Claims U.S. is leading China in crypto dominance; praises government BTC reserves.

- Mentions no knowledge of $2B UAE digital coin deal tied to Trump company, but calls himself a “big crypto fan.”

Onboard Air Force One, former President Donald Trump made bold statements about cryptocurrency, signaling a renewed interest in the global crypto race. During an informal press gaggle, Trump elevated Bitcoin’s status while emphasizing the United States’ position over China in the digital asset space.

Read More: Trump Administration Seeks to Build Largest U.S. Bitcoin Reserve

Trump’s $10 Trillion Bitcoin Remark Draws Attention

In an unfiltered moment with reporters, Trump described Bitcoin as “a $10 trillion asset class.” Although the figure may not reflect the current market cap — which, as of now, stands just above $1.9 trillion — his comment suggests a belief in Bitcoin’s long-term potential.

He followed up by saying, “I’m a big crypto fan,” a shift from his previously skeptical tone during his presidency. These remarks came after he was asked about a UAE-backed digital coin deal reportedly involving his family’s company. Trump denied knowledge of the transaction but used the moment to reinforce his stance on crypto leadership.

“If the U.S. doesn’t lead in crypto and AI, China will,” he warned.

The comment positions crypto not just as an asset, but as a key battleground in technological and economic supremacy.

U.S. vs. China: The Quiet Bitcoin Arms Race

While Trump declared that America is “leading China in crypto,” the actual metrics tell a nuanced story. According to government disclosures, the U.S. holds approximately 198,000 BTC, mostly acquired through legal seizures from operations like Silk Road and ransomware crackdowns. These coins are kept off the market — effectively making the U.S. a long-term holder of digital assets.

By contrast, China controls about 190,000 BTC, although its holdings come via a different route. Despite banning crypto trading and mining in recent years, Chinese firms still dominate critical parts of the blockchain ecosystem. Major Chinese companies manufacture a majority of ASIC mining rigs and operate back-end services for global mining operations.

Infrastructure vs. Custody – Different Approaches to Dominance

While the U.S. controls more coins directly, China’s control over infrastructure — from manufacturing chips to operating mining farms — gives it strategic leverage. Trump indirectly acknowledged this when he said, “Please tell me a big project from China in crypto, I will support it,” signaling both competitive respect and an open challenge.

Crypto Markets Shrug Off Trump’s Comments

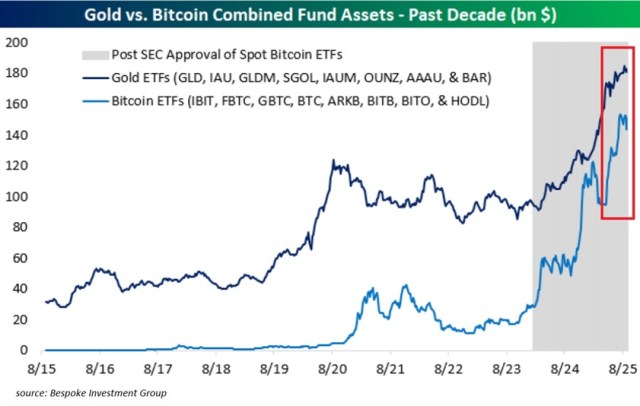

Interestingly, the crypto market remained flat despite Trump’s remarks. Bitcoin was trading at around $103,090 during the gaggle, showing no immediate volatility from the statement. Just months ago, such a bullish endorsement from Trump might have caused sharp swings.

Traders’ muted reaction suggests the market may now be factoring in more than political soundbites — focusing instead on macro trends like ETF approvals, Fed policy, and global regulatory clarity.

This signals a shift in the market’s maturity. As one analyst from Galaxy Digital put it, “The market’s reaction shows it’s not about who says it anymore — it’s about what’s being built.”

Read More: Trump Enters Web3: Monopoly-Themed Crypto Game in the Works

Crypto in Diplomacy: Unofficial But Unavoidable

Though Trump said he hadn’t talked about crypto with Emirati or Saudi officials, digital assets are clearly starting to be included in diplomatic and economic conversations. The trip saw the U.S. announce a strategic $600 billion pact with Saudi Arabia mostly on infrastructure and trade.

Although crypto was not included on the official agenda, Trump’s casual comments suggest that blockchain assets are becoming more important in big geopolitical decisions.

His praise for Crown Prince Mohammed bin Salman and acknowledgment of Gulf states’ assistance in hostage negotiations further reinforce the tightening relationship between Washington and Middle Eastern powers — many of which are actively investing in crypto infrastructure.

Political Optics and Future Signals

Trump seems to be matching important tech and financial trends before a possible 2024 election run by linking himself with Bitcoin and artificial intelligence developments. His position might appeal to young, tech-savvy voters and investors disappointed with conventional banks.

It also creates a probable policy difference with authorities such as Gary Gensler of the SEC, who keeps looking at digital assets as securities.

Trump’s comments also highlight the absence of consistent federal crypto control, which insiders have pointed out hinders U.S. innovation in the field. His framing of cryptocurrency as part of a worldwide race could affect future legislative priorities, particularly as lawmakers evaluate digital currency’s impact on economic competitiveness.

Recorded aboard Air Force One during an off-camera gaggle, this pool report contains Trump’s interactions with reporters’ quotations and summaries. These remarks have not yet been officially clarified or expanded upon by his campaign or spokespersons.

The post Trump Calls Bitcoin a $10 Trillion Asset as U.S.-China Crypto Rivalry Heats Up appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments