As Bitcoin (BTC) pushes past the psychologically important $100,000 milestone, on-chain data suggests that an increasing number of whales – wallets with significant BTC holdings – are accumulating the top cryptocurrency at a rapid pace.

Bitcoin Whales Increase Their Holdings

In a CryptoQuant Quicktake post published today, contributor caueconomy noted a significant uptick in whale activity over the past 30 days. Specifically, Bitcoin whales – defined as wallet addresses holding between 1,000 and 10,000 BTC – have increased their total holdings by approximately 41,300 BTC during this period.

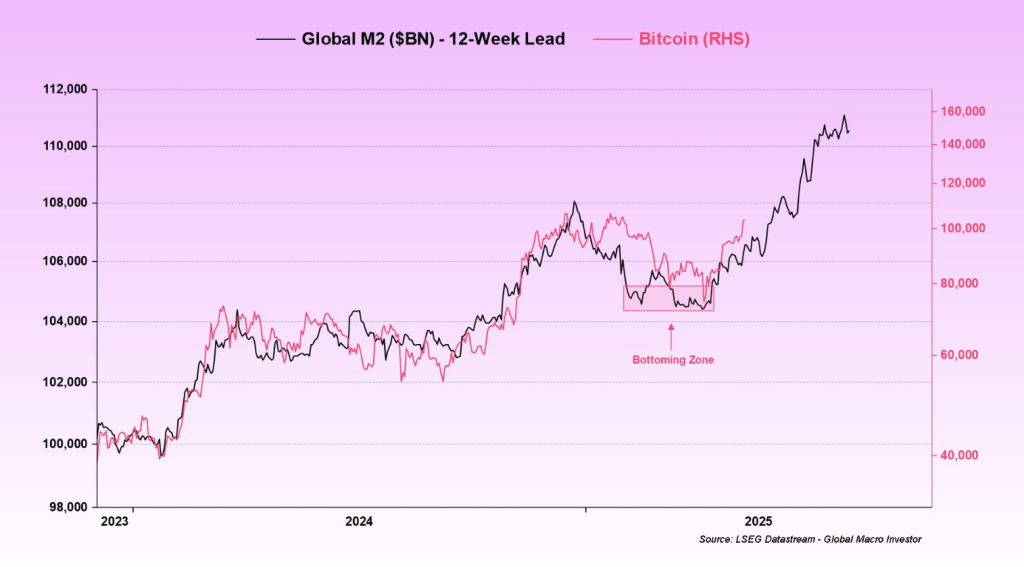

According to the analyst, this rise in BTC whale accumulation reflects growing institutional interest in the asset class. Despite ongoing global economic uncertainty and high risk aversion, large-scale investors appear to be doubling down on Bitcoin.

Notably, caueconomy emphasized that institutional interest has carried over into 2025, with a new wave of corporate entities seeking to add BTC to their treasuries. The analyst explained:

This constant interest in absorption by companies can generate uninterrupted and acyclical buying pressure, since these corporations use their own cash generation and debt issuance to buy. And as I have already mentioned in previous posts, this rise in bitcoin prices is not being driven by retail activity, but by institutional “passive” buying pressure.

It should be recalled that the recent slump in BTC price to $74,508 did not deter BTC whales from accumulating the premier digital asset. Recent data from on-chain analytics platform Santiment suggests that BTC whales addresses have been at their highest level since December 2024.

In fact, 76 new BTC whales were added to the network during February and March 2025 alone. Historically, growth in whale addresses during periods of price downturn has often preceded significant price recoveries in Bitcoin.

Corporate Adoption Of BTC Continues To Rise

The first quarter of 2025 has also seen a sharp uptick in corporate adoption of Bitcoin. In April 2025, Japanese firm Metaplanet announced plans to accumulate 10,000 BTC as part of its long-term corporate treasury strategy.

Similarly, Strategy, the company with the largest BTC holdings, kicked off May with a massive $180 million BTC purchase. Meanwhile, France-based The Blockchain Group acquired 580 BTC in April – marking its largest monthly purchase since it began accumulating Bitcoin in November 2024.

Looking ahead, institutional interest in Bitcoin is expected to remain strong throughout the rest of the year, despite mounting macroeconomic pressures such as a looming global tariff war. At press time, BTC trades at $102,746, up 1.9% in the past 24 hours.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments